Your AI Guide for Safer Credit Decisions

Assess your Thin/No files businesses and offer safe credit

SUPPORTED BY

We've cracked the business transaction with AI

With comprehensive transaction history, a complete picture of business health is possible

For Financial Institutions

Launch Financing to an underserved SMB market

Underwrite the unbankable

Generate predictive insights from bank transactions on thin/no file cases.

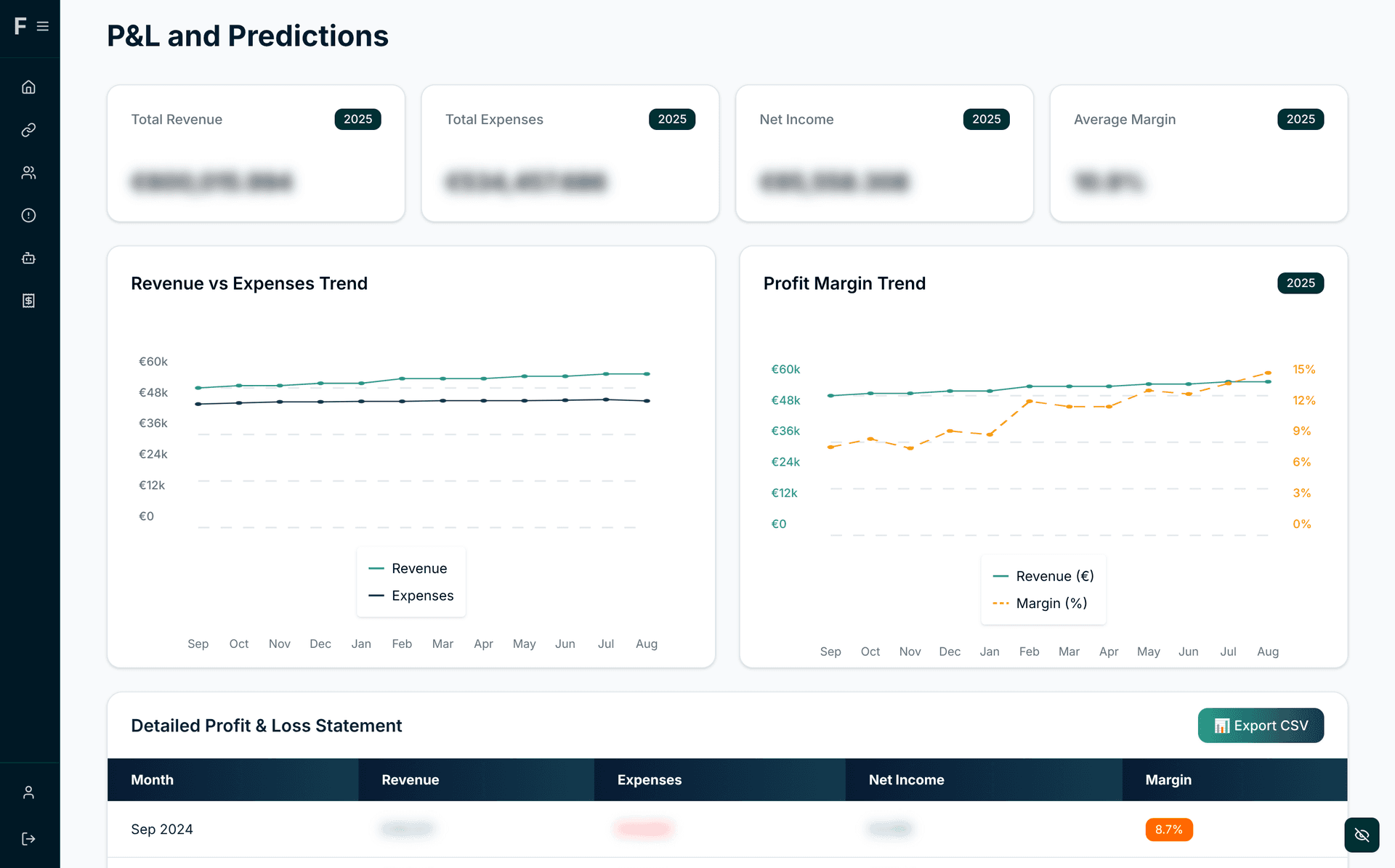

Predictive Cashflow Modeling

Forecast cash flow seasonality and volatility.

Entity Resolution (KYB)

Identify connections between people, businesses, and accounts to detect fraud or inflated risk.

For Suppliers

Offer flexible payment options to buyers with safety

Boost sales

Offer flexible payment terms to gain a competitive advantage.

Automate AR processes

Automate routine reconciliation tasks to focus on high-value activities.

Customer Monitoring

Real-time customer financials tracking to prevent late payments and defaults.